Explain Different Types of Currency Swaps

Currency swaps are priced or valued in the same way as interest rate swaps using a discounted cash flow analysis having obtained the zero coupon version of the swap curves. Hybrid swaps allow their holders to swap financial flows associated with different debt instruments that are also denominated in different currencies.

Options Derivatives Trading.

. There are two types of commodity swaps that are generally used. A dual currency swap is a type of derivative that allows investors to hedge the currency risks associated with dual currency bonds. There are two main types of cross-currency swaps.

Plain Vanilla Foreign Currency Swap. The most commonly encountered types of currency swaps include the following. The plain vanilla currency swap involves exchanging principal and fixed interest payments on a loan in one currency for principal and fixed interest payments.

Traders Can Buy Sell Trade Cryptocurrencies All in a Single Hassel-Free Crypto Platform. It also specifies an initial exchange of notional currency in each different currency and the terms of that repayment of notional. Interest rate swaps involve exchanging interest payments while currency swaps involve exchanging an amount of cash in one currency for.

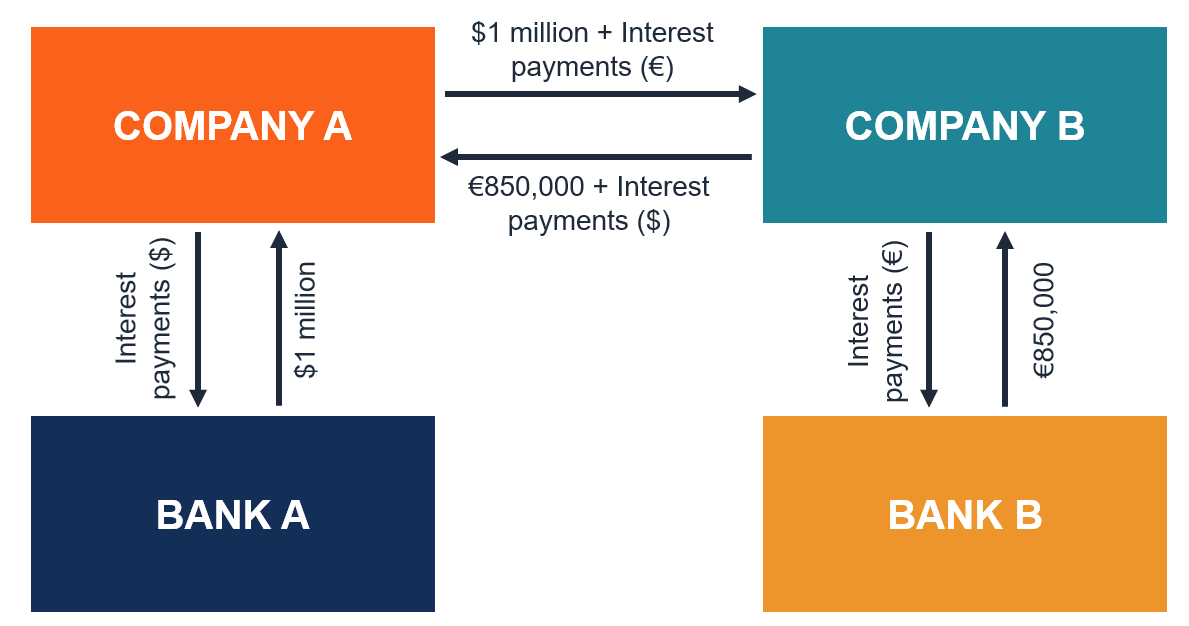

In this type of derivative contract both the principal and interest payment in one currency are. Generally a currency swap transacts at inception with no net value. At the inception of the swap the equivalent principal amounts are exchanged at the spot rate.

In this type of swap parties agree to exchange interest payments. Over the life of the instrument the currency swap can go in-the-money out-of-the-money or it can stay at-the. Currency swaps allow their holders to swap financial flows associated with two different currencies.

A commodity swap is. There are two main types of currency swaps. Types of Swaps 1 Interest rate swap Interest Rate Swap An interest rate swap is a derivative contract through which two counterparties.

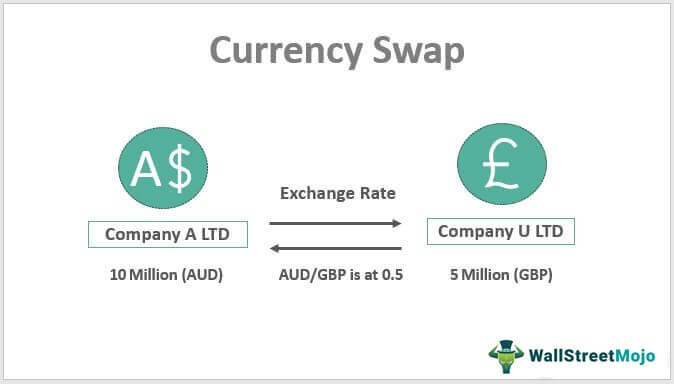

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. In the first case two companies exchange principal amounts that determine their desired or agreed rate of foreign exchange. For example US dollars at fixed rates can be swapped against sterling with LIBOR floating rate.

In this type of swap parties agree to exchange interest payments. Swaps Interest Rate Swaps. Different Types of Swaps.

Types of Cross Currency Swaps. A Plain Vanilla Swap. Stages in Currency Swap.

Float swap is commonly referred to as basis swap. This involves the exchange of one form of an interest rate for another to reduce fluctuations in. Credit Default Swap is a financial instrument for swapping the risk of debt default.

Among types of swaps the Bank for International Settlements or BIS distinguishes cross currency swaps from FX swaps Rate Exchanges. Different Types of Swaps 1. A cross-currency swaps XCSs effective description is a derivative contract agreed between two counterparties which specifies the nature of an exchange of payments benchmarked against two interest rate indexes denominated in two different currencies.

In this form of swap fixed rate obligations in one currency are swapped for floating rate obligations in another currency. One leg of the currency swap represents a stream of fixed interest rate payments while another leg is a. In a floating to floating swap it is possible to exchange the floating rates based on different.

The fixed-for-fixed currency swap involves exchanging fixed interest payments in one currency for fixed interest payments in. The most basic type of swap is a plain vanilla interest rate swap. This is the simplest form of Interest rate swaps where a fixed rate is exchanged for a floating.

Exchange of principal and exchange of interest. 2 Currency swap Currency Swap Contract A currency swap contract also known as a cross-currency swap contract is a. Investors use this type to.

Ad New Approved Crypto Accounts Will Receive 10 in a Supported Cryptocurrency. During the length of the swap each party pays the interest on the swapped principal loan amount. Fixed-Floating Commodity Swaps Fixed-floating swaps are very similar to interest rate swaps.

Cross currency swaps are agreements between counter-parties to exchange interest and principal. 3 Commodity swap Commodity Swap A. Fixed to Floating Cross Currency Swap.

Fixed-floating commodity swaps and commodity-for-interest swaps. Unlike in a cross currency swap in an FX swap there are no exchanges of interest during the contract term and a differing amount of funds is exchanged at the end of the contract.

Currency Swap Definition Example How This Agreement Works

:max_bytes(150000):strip_icc()/DifferentTypesofSwaps2-4de5ab58b9854ca6b325de77810c3b16.png)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

Comments

Post a Comment